Sports Value analyzes numerous sectors that investing in sports marketing, with special attention to sports goods and equipment and also sports retail brands. We have prepared this comprehensive and exclusive material about this vibrant and creative industry.

According to McKinsey data, the global sports goods market reached US$ 295 billion in sales, with approximately 35% of it in the United States.

Therefore, the U.S. market alone accounts for over US$ 100 billion annually.

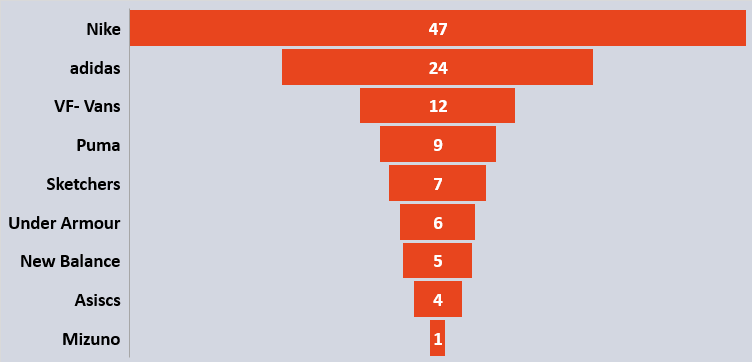

Revenue in 2022 – Top sports goods groups – US$ Bn

These 10 corporate groups measured by Sports Value generated a total of US$ 118 billion in sales in 2022.

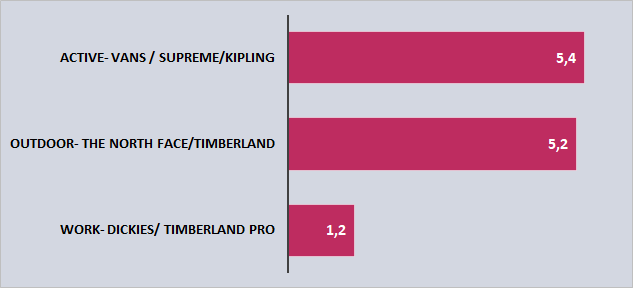

Notably, the VF Group stood out with total sales of US$ 11.8 billion in 2022, featuring iconic brands in the portfolio such as Vans, The North Face, Timberland, Kipling, and others.

The U.S. market accounts for US$ 6.2 billion in sales, Europe for another US$ 3.4 billion, Asia and the Pacific for US$ 1.6 billion, and the rest of the Americas, including Latin America, for US$ 627 million in 2022.

VF Group – 2022 Sales – US$ Bn

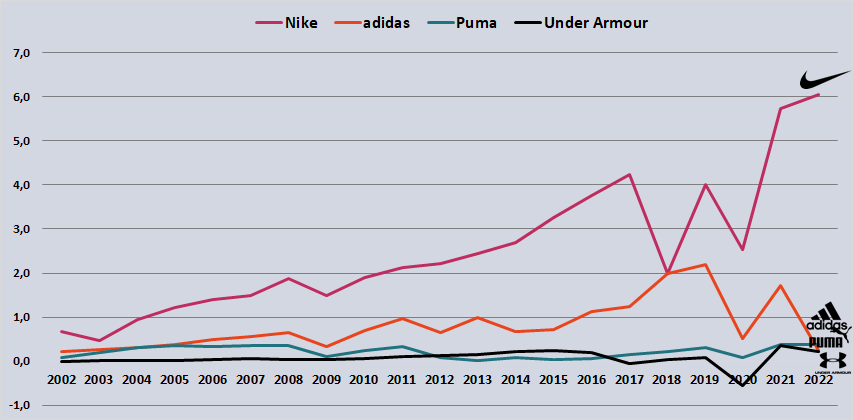

The Nike, adidas, Puma, and Under Armour warfare

The sports market features four major players engaged in a fierce battle for teams, leagues, athletes, and competitions. The brands Nike, adidas, Puma, and Under Armour (UA) are literally engaged in a global dispute aiming to captivate sports fans with diverse marketing strategies.

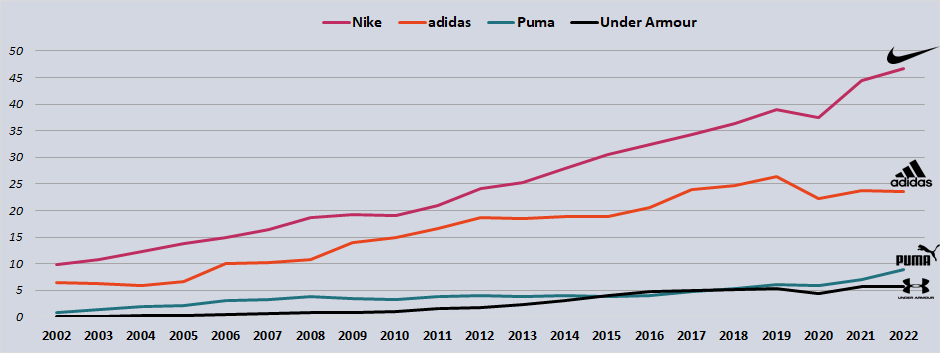

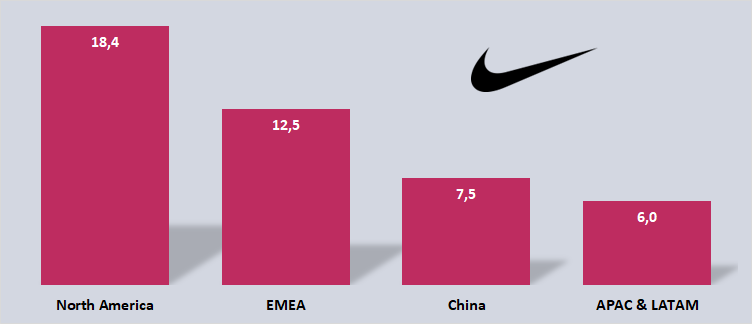

The global sales of this BIG 4 amounted to US$ 85 billion in 2022, with Nike dominating in sales and profits. The American company generated US$ 46.7 billion in 2022 and recorded a profit of US$ 6 billion. The combined revenues of Adidas, Puma, and UA totaled US$ 38 billion in this year.

For comparison, adidas generated revenues of US$ 23.6 billion and profits of only US$ 239 million. The best recent year for the German brand was in 2019, with US$ 2.2 billion in net profits. In 2021 finished the year with US$ 1.7 billion in net results.

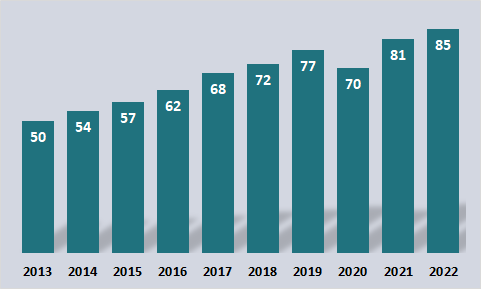

Combined Revenues – Nike, Adidas, Puma, and UA – US$ Bn

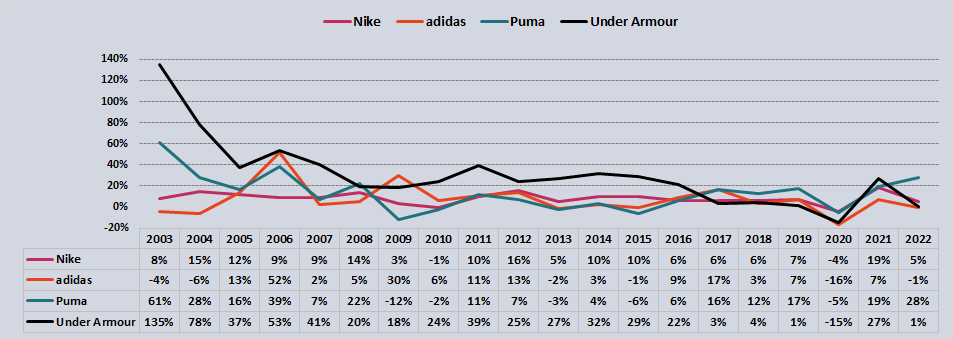

The pandemic affected revenues in certain areas, such as physical stores, but it accelerated ongoing digital processes. Thus, by 2021, the numbers had already recovered from the losses of 2020.

The combined revenues of the four brands went from US$ 77 billion in 2019 to US$ 70 billion in 2020, and then jumped to US$ 81 billion in 2021 and now US$ 85 billion in sales.

Historical Revenues – US$ Bn

Annual Revenue Growth in dollars – In %

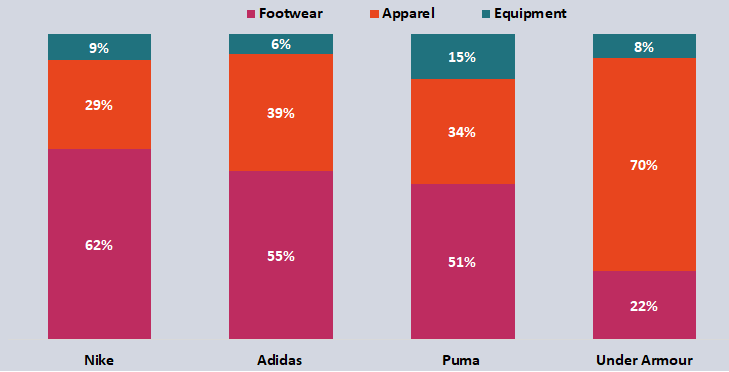

Nike maintains an absolute dominance in sneaker sales, with as much as 62% of its revenues coming from footwear. For adidas, this index stands at 55%, Puma at 51%, and UA 22%.

Nike concluded 2022 with US$ 29.1 billion in sneaker sales, including US$ 12.2 billion in North America and another US$ 7.4 billion in Europe, the Middle East, and Africa. The brand’s clothing line generated US$ 13.6 billion and has potential for growth.

In contrast, adidas ended 2022 with US$ 13 billion in footwear sales and another US$ 9.1 billion from its clothing line. Puma achieved US$ 4.5 billion in sneaker sales and US$ 3 billion in apparel.

UA heavily relies on apparel generating US$ 3.9 billion in 2022, compared to only US$ 1.3 billion in footwear.

Sales by Category – In 2022 – %

Global Nike sales in 2022– US$ Bn

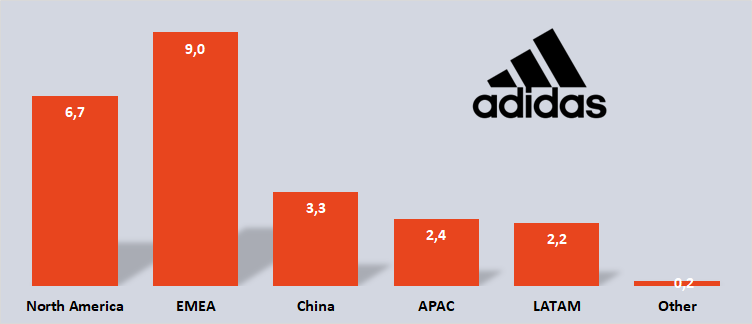

Global adidas sales in 2022 US$ Bn

Besides Nike’s growth, which significantly impacts the market, there was notable growth from Puma, with US$ 8.9 billion in sales in 2022.

Puma’s revenues have accelerated in recent years, with a remarkable 28% growth in 2022, compared to Nike’s 5%.

UA generated US$ 5.7 billion in 2022, lagging behind. In 2015, it surpassed Puma in global revenues, and it was only surpassed in 2018, when the German brand was experiencing rapid revenue growth.

Since 2017, Puma has been growing at a double-digit rate every year. Sales were at US$ 4.7 billion in 2017, jumped to US$ 6.2 billion in 2019, and experienced a downturn due to the pandemic.

With a return to normality in 2021, sales reached US$ 7 billion and currently stand at US$ 8.9 billion – an impressive growth!

Marketing budgets

One of the secrets to the success of sports equipment brands is their investment in marketing and promotional tools. These brands engage in financial battles for the best sports properties, including teams, players, and leagues.

Correct choices define the brand’s financial future. The costs are extremely high, and making the wrong choice can be detrimental.

Combined, these brands invested a total of US$ 8.4 billion in marketing budgets in 2022, including sponsorships and advertising expenditures.

On average, the marketing budget accounts for 11% of the sales of the four brands.

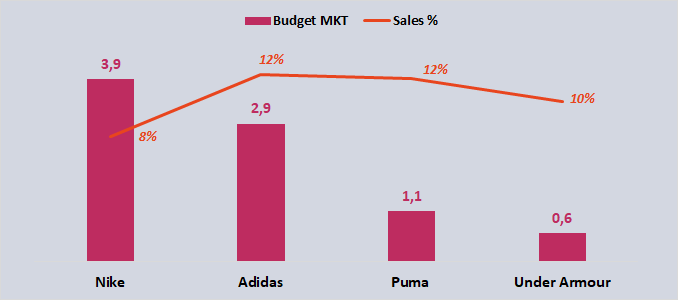

Marketing Budget -In 2022- US$ Bn

In 2022, Nike invested US$ 3.9 billion in demand creation, which represented 8% of sales. Adidas invested US$ 2.9 billion, with its budget accounting for 12%.

Puma’s marketing budget has grew significantly in recent years and reached US$ 1.1 billion in 2022 for the first time. In 2018, Puma’s budget was US$ 561 million, compared to UA’s US$ 565 million. Currently, Puma’s budget is 1.8 times larger.

Companies’ profitability

The sports goods market operates with high costs and heavy investments, making profitability depend on a range of sports and market-related factors.

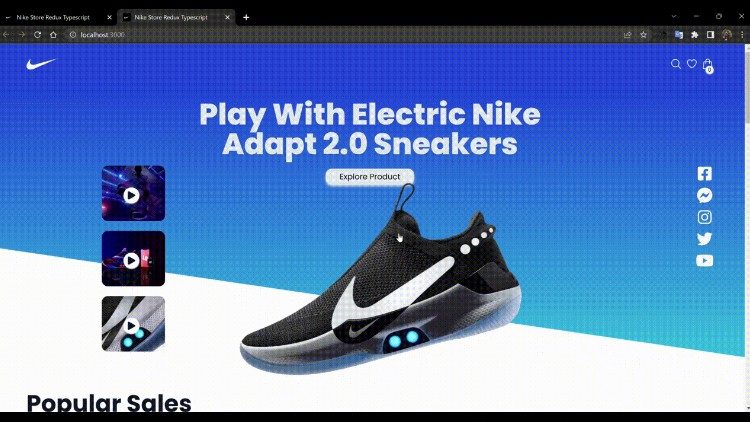

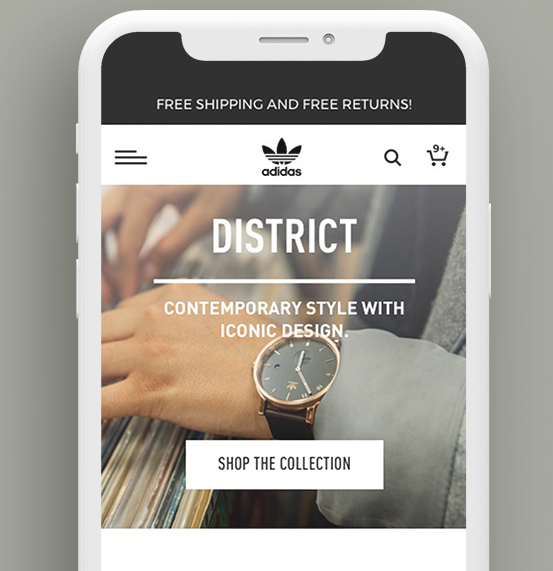

An increasingly strong trend is the push for direct-to-consumer sales, both in company-owned physical stores and online sales. For many brands, Direct to Consumer (D2C) already accounts for over 40% of sales.

Net profits by brand – US$ Bn

In the past five years, Nike accumulated net profits of US$ 20 billion, compared to adidas US$ 6.7 billion. Puma gathered profits of US$ 1.3 billion over the same period.

How the Jordan brand revolutionized the sneaker market?

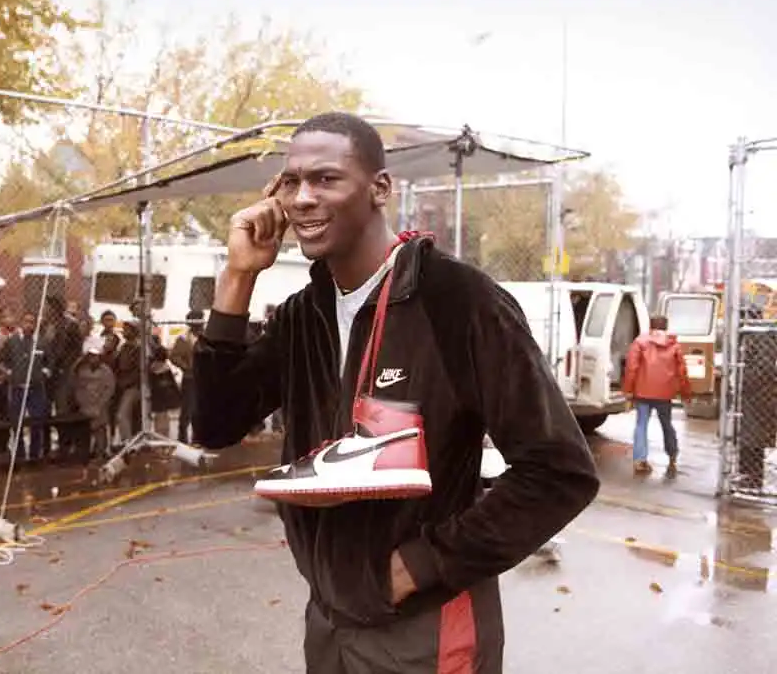

Nike and Jordan: A Perfect Match

The movie “Air” portrays the relationship between Nike and Michael Jordan and should be seen as a lesson in sports marketing. While the company was already generating revenue, it was far from the current US$ 46.7 billion.

Jordan became a Nike´s partner and now earns more through a percentage of sales than he did as a player. Estimated annual earnings are around US$ 250 million.

Michael Jordan’s net worth is currently valued at US$ 3.5 billion, according to Forbes.

“Last Dance” Series Boosts Sales

The Jordan brand, with the significant impact of the Last Dance series during the pandemic, witnessed its sales skyrocketed.

While everything was closing, young enthusiasts captivated by the jersey number 23 stories, rushed to e-commerce after watching it on Netflix.

The doc was viewed by an average of 5.6 million people in the US on ESPN, and 24 million watched, at least a part, on Netflix in the first month of release.

The brand, which had already been heavily investing in its pop culture image, transformed into something much larger than basketball sneaker It became part and desire of the connected youngster in the urban street culture.

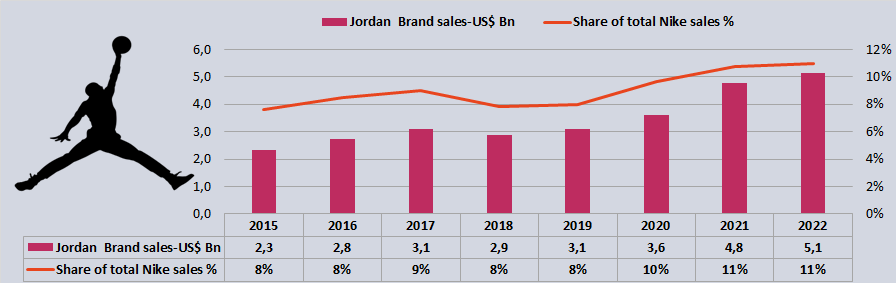

Revenues – Jordan brand – US$ Bn

The Jordan brand’s revenue in 2022 exceeded US$ 5 billion for the first time. Previously, it accounted for 8% of Nike’s sales, and now it’s at 11%.

The products are expensive and highly value-added, a dream for all brands. Associations with NBA teams and the entry into soccer with PSG were extremely strategic decisions.

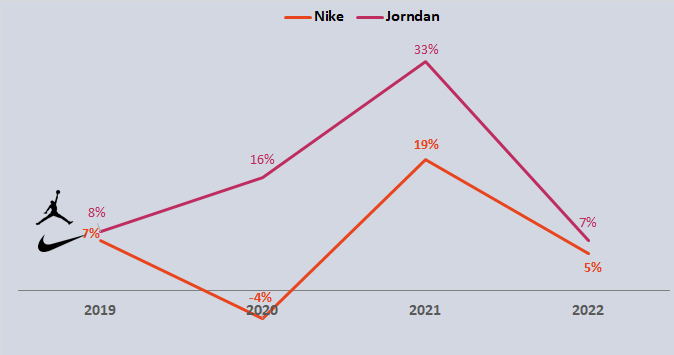

Growth – Jordan vs. Nike – In %

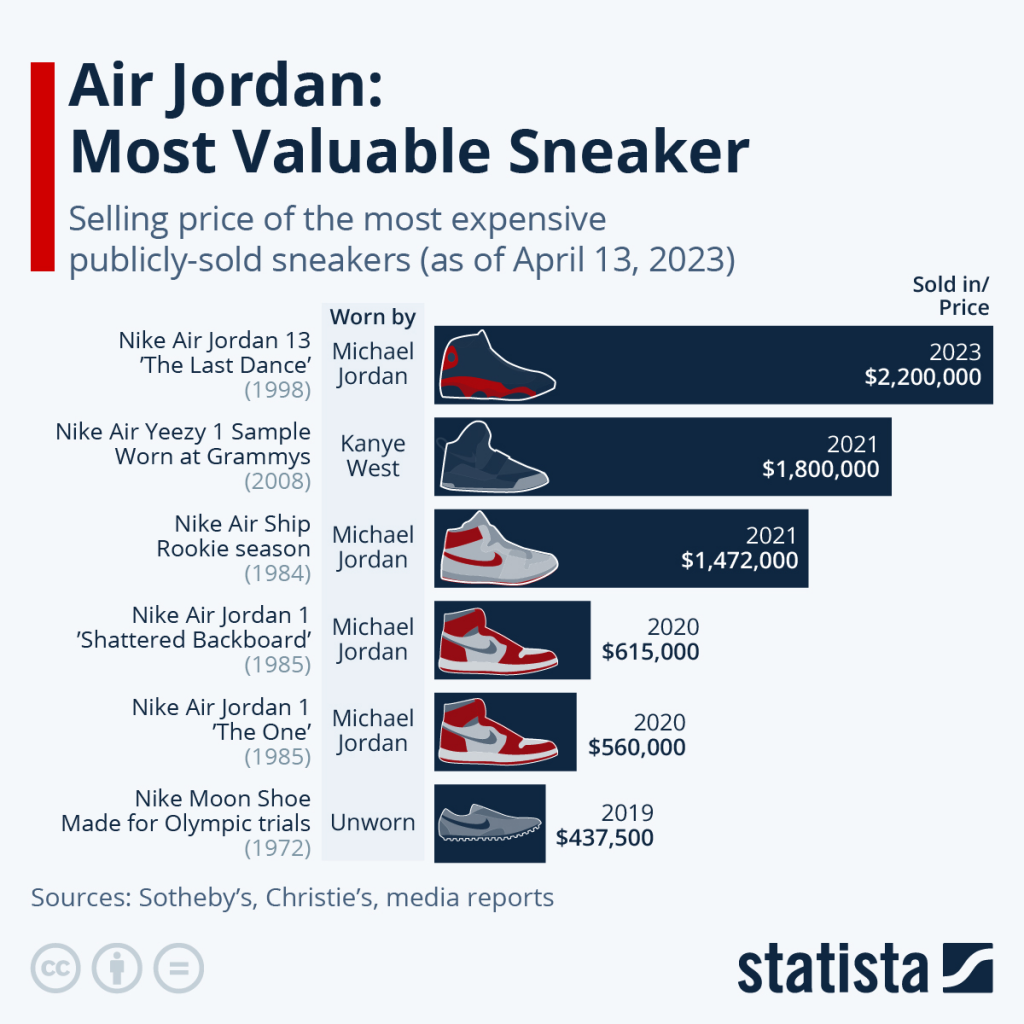

Original Sneakers Auction

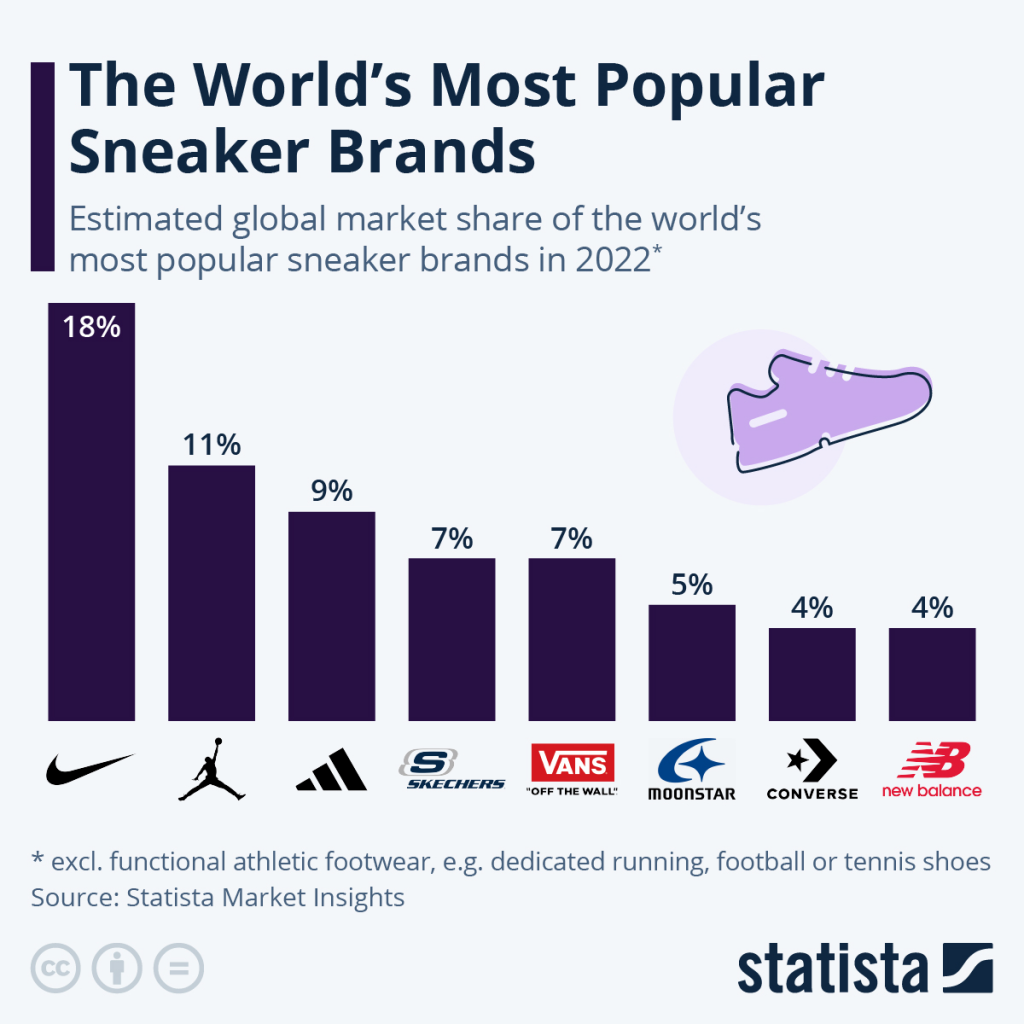

An interesting fact has gone viral: Jordan only sells fewer sports sneakers worldwide than Nike, outperforming giants like adidas.

Converse X Jordan

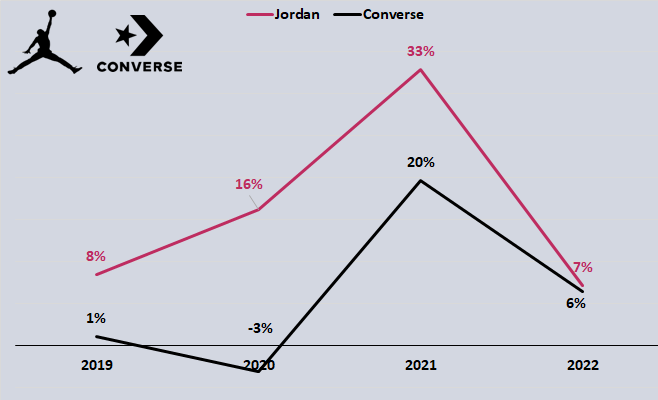

An interesting comparison can be drawn between the evolution of the Jordan brand and Converse, another brand connected to an audience interested in lifestyle and is also a part of Nike Group.

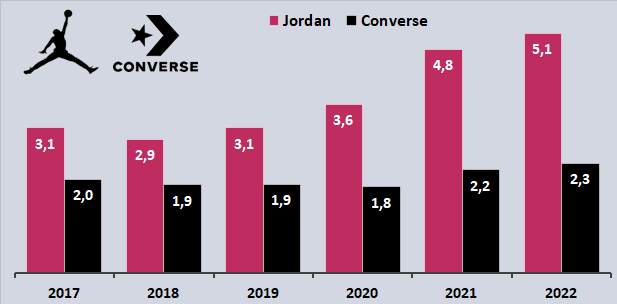

Revenues – Jordan vs. Converse – US$ Bn

In 2017, Converse generated US$ 2 billion in revenue, while Jordan generated US$ 3.1 billion. Currently, the Converse brand generates US$ 2.3 billion, in contrast to Jordan’s US$ 5.1 billion global sales.

Growth – Jordan vs. Converse – In %

Other athlete brands

LeBron James

Like the Jordan brand, LeBron has become a giant in sneaker sales. Nike created a separate brand for King James, which generates over US$ 600 million annually.

Stephen Curry

The Golden State Warriors star, the leading NBA´s three-point scorer, has an exclusive contract with Under Armour. Sales have grown thanks to the correct choice of one of today’s biggest sports names.

Messi

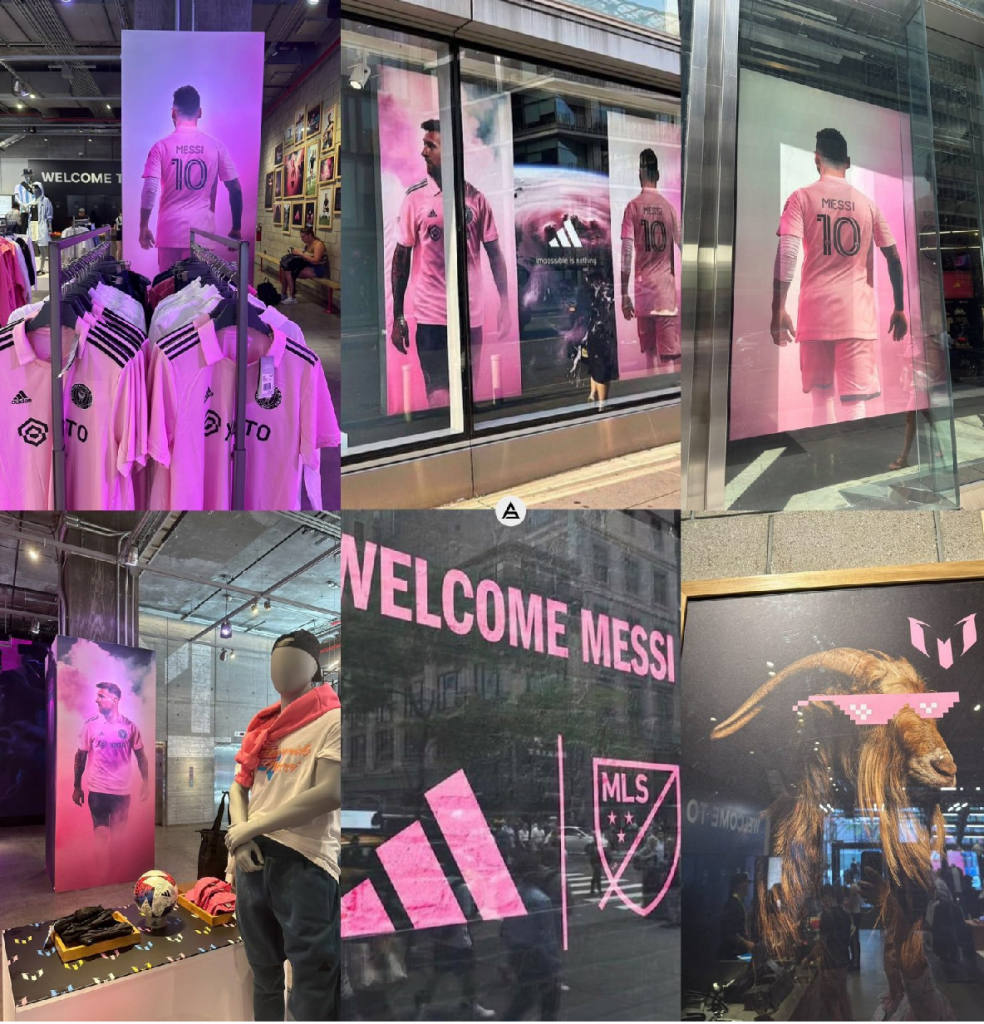

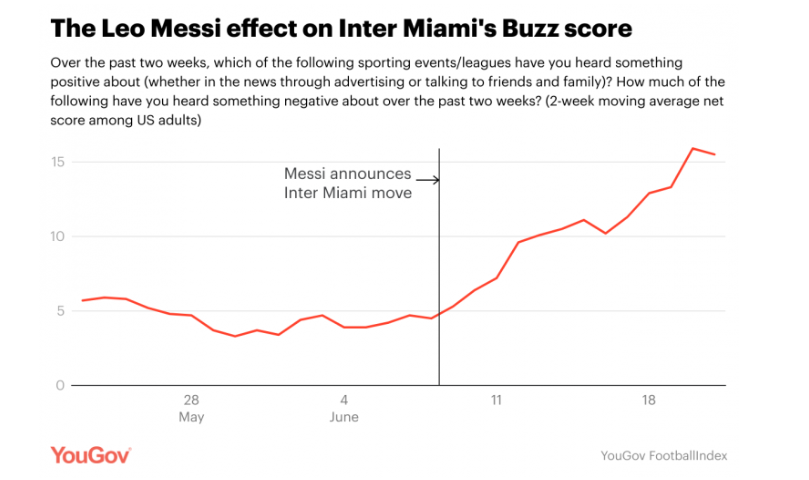

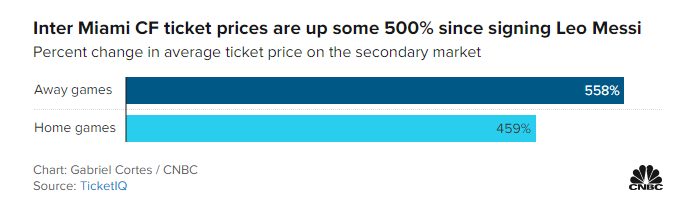

The Argentine star is sponsored by Adidas, and his success in the United States is greatly benefiting the German brand in the territory of its main rival.

The “Messimania” is positively impacting Adidas’ sales, as it is the official sponsor of the MLS, dressing all the teams in the competition.

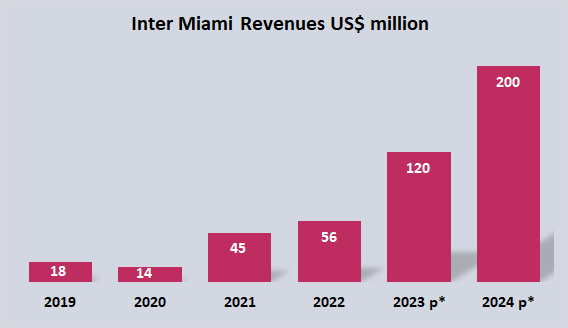

*2023- 2024- Club´s projection

English - EN

English - EN

Português - PT

Português - PT  Español - ES

Español - ES